mass tax connect make estimated payment

Payments must have the status Submitted to be deleted. This video tutorial gives you an overview of the MassTaxConnect system including how to set up an account andor log in.

3 Billion Mass Tax Surplus Being Returned To Taxpayers Nbc Boston

Payments with a status of Is in.

. All corporations that reasonably estimate their corporate excise to be in excess of 1000 for the taxable year are required to make estimated tax payments to Massachusetts. Youll learn how to pay a tax bill or make an extension. Your browser appears to have cookies disabled.

Massachusetts residents who earn a gross income of at least 8000 need to file a tax return. Access account information 24 hours a day 7 days a week. The first step in making estimated tax payments is to calculate what you owe.

800 392-6089 toll-free in Massachusetts You may also connect with DOR with MassTaxConnect by email or in person. Payments in MassTaxConnect can be removed from the Submissions screen. The reason why it is an estimated tax payment is because you do not know exactly what your tax.

Make a Payment with. ONLINE MASS DOR TAX PAYMENT PROCESS. For some workers tax season doesnt end on April 19.

Review your payment and select Submit. With a MassTaxConnect account you can. Under Quick Links select Make a payment in yellow below.

Under Quick Links select Make a payment in yellow below. Business taxpayers can make bill payments on MassTaxConnect without logging in. All business corporations that reasonably estimate their corporation excise to be in excess of 1000 for the taxable year are required to make estimated payments.

Cookies are required to use this site. Business and fiduciary taxpayers must log in to make estimated extension or return. Enter your SSN or ITIN and phone number in case we need to contact you about this payment Choose the type of tax payment you want to make and select Next.

You can make your personal income tax payments without logging in. Access account information 24 hours a day 7 days a week. Submit and amend most tax returns.

Welcome to MassTaxConnect the Massachusetts Department of Revenues web-based application for filing and paying taxes in the Commonwealth. Make estimated tax payments. Welcome to MassTaxConnect the Massachusetts Department of Revenues web-based application for filing and paying taxes in the Commonwealth.

Use this link to log into Mass Department of Revenues site. Make bill payments return payments.

Massachusetts Department Of Revenue Boston Ma

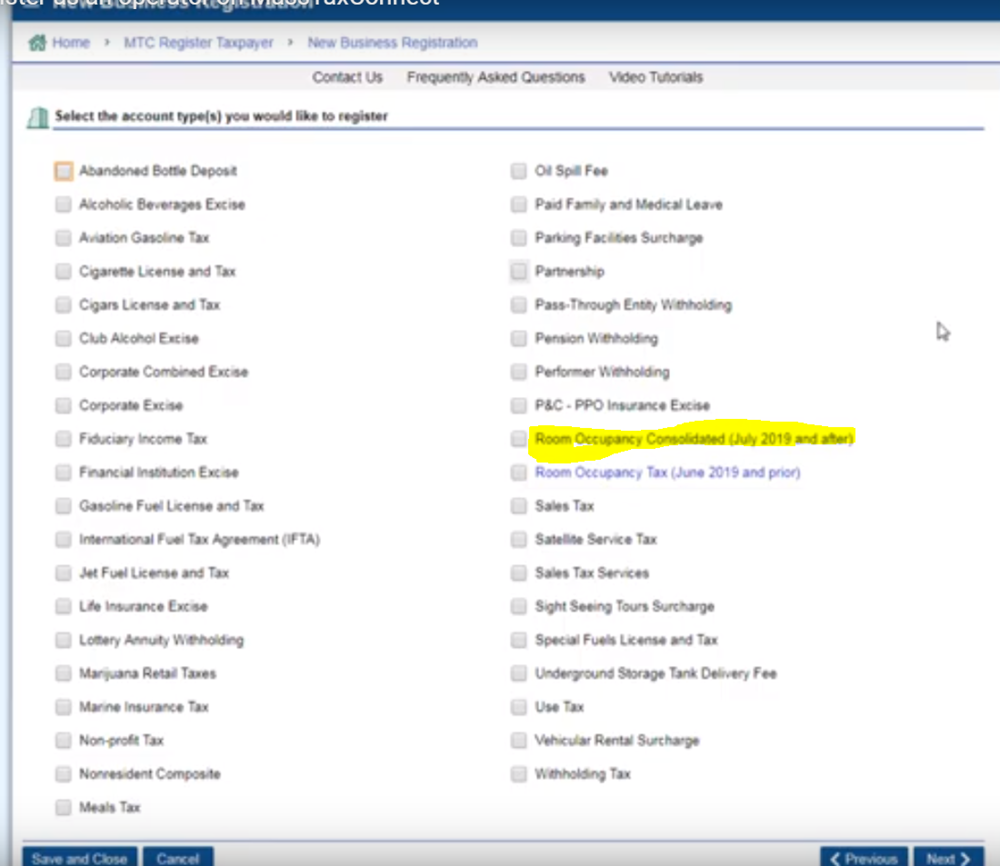

Massachusetts Airbnb Vrbo How To Register For The Room Occupancy Tax

1040 2021 Internal Revenue Service

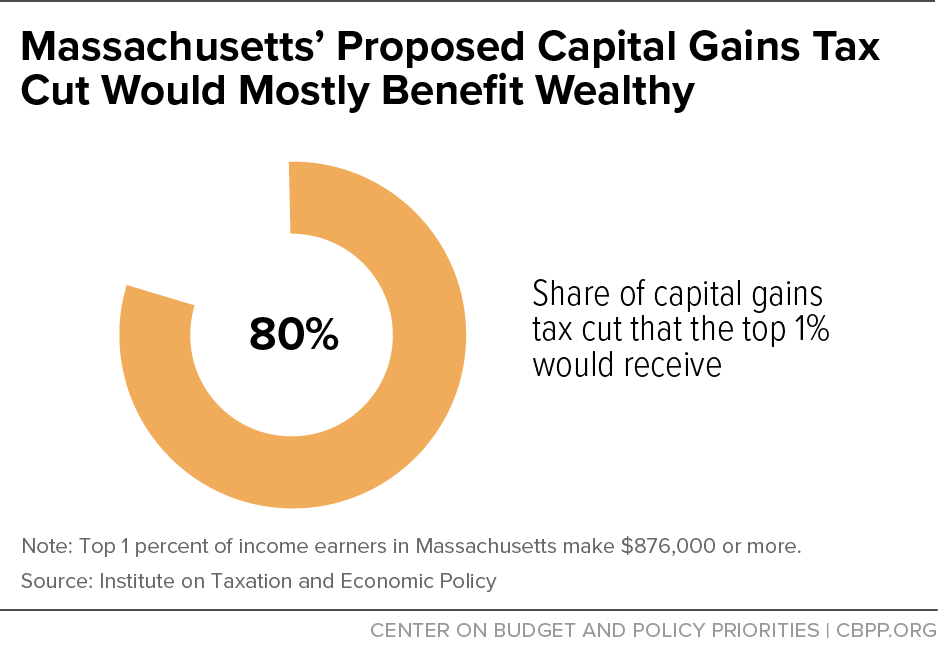

Massachusetts Should Focus On Building An Equitable Recovery Not Tax Cuts For The Wealthy Center On Budget And Policy Priorities

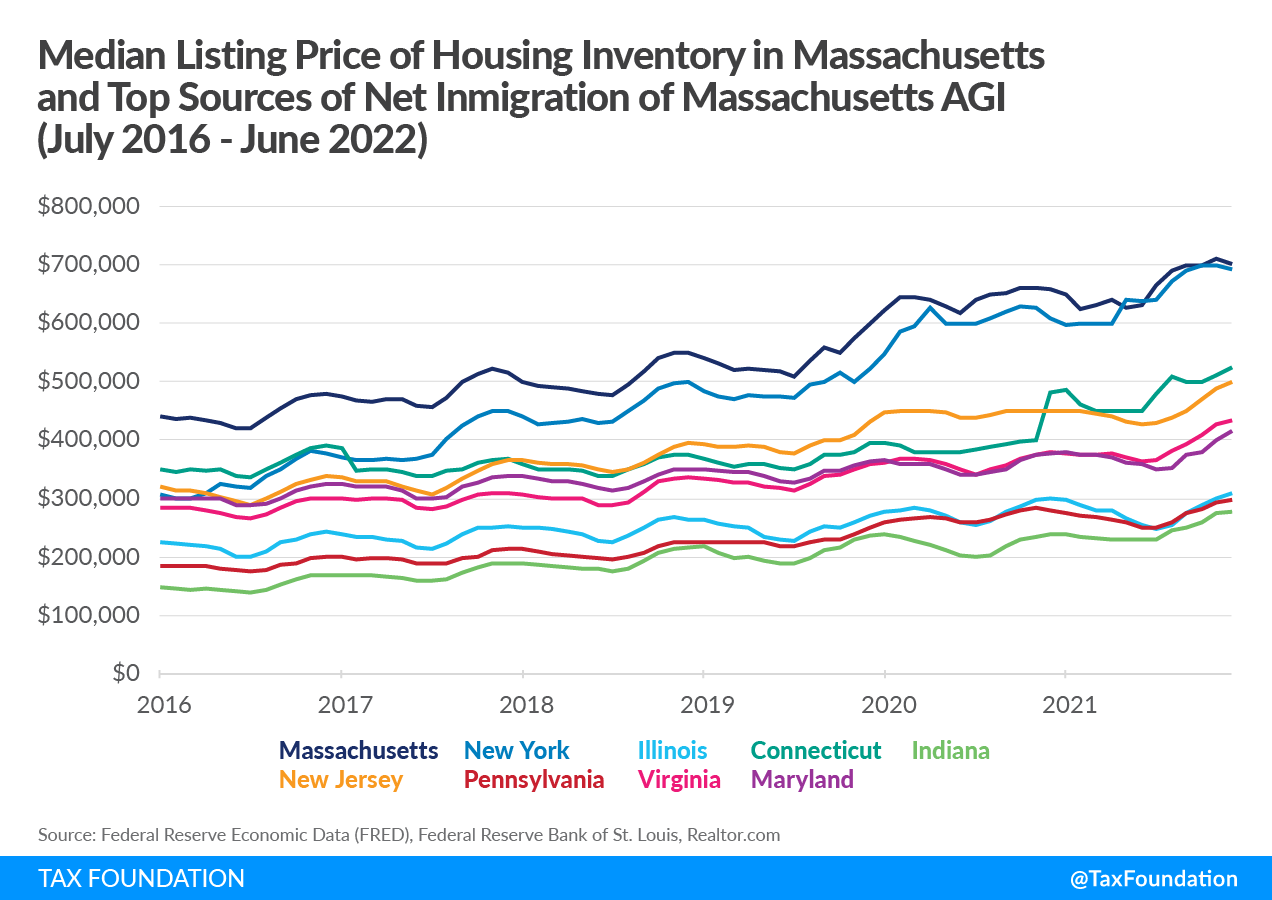

Massachusetts Graduated Income Tax Amendment Details Analysis

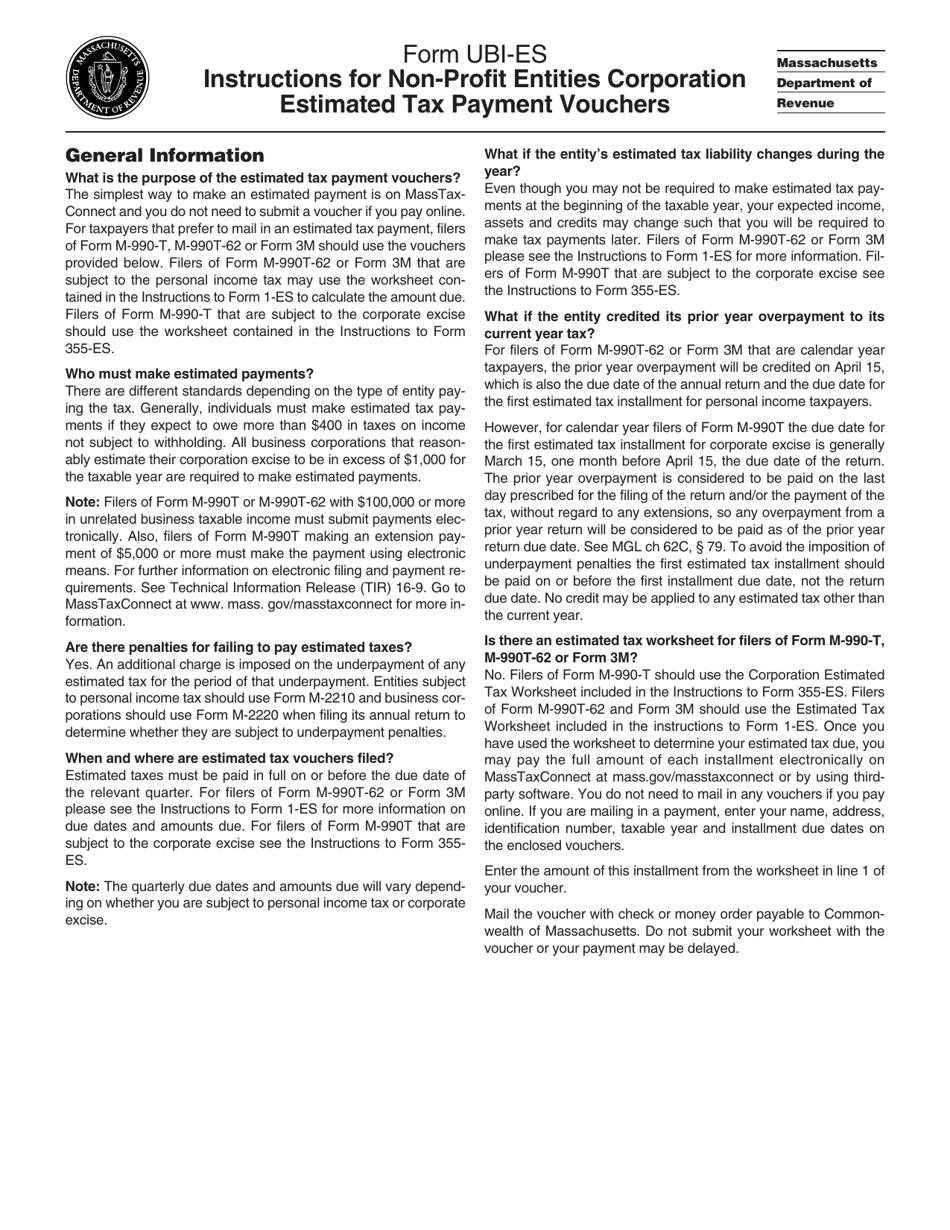

Form Ubi Es Download Printable Pdf Or Fill Online Non Profit Entities Corporation Estimated Tax Payment Vouchers 2022 Massachusetts Templateroller

How Owners Of Short Term Rentals Can Register Their Property Cciaor

Estimated Tax Payment Quarterly Tax Payments Self Employment Tax

Massachusetts Should Focus On Building An Equitable Recovery Not Tax Cuts For The Wealthy Center On Budget And Policy Priorities

How To Make Ma Dor Income Tax Payments Online The Onaway

Massachusetts Dept Of Revenue Massrevenue Twitter

Billions In State Tax Refunds To Start Flowing To Taxpayers Today Officials Say The Boston Globe

How To File And Pay Sales Tax In Massachusetts Taxvalet

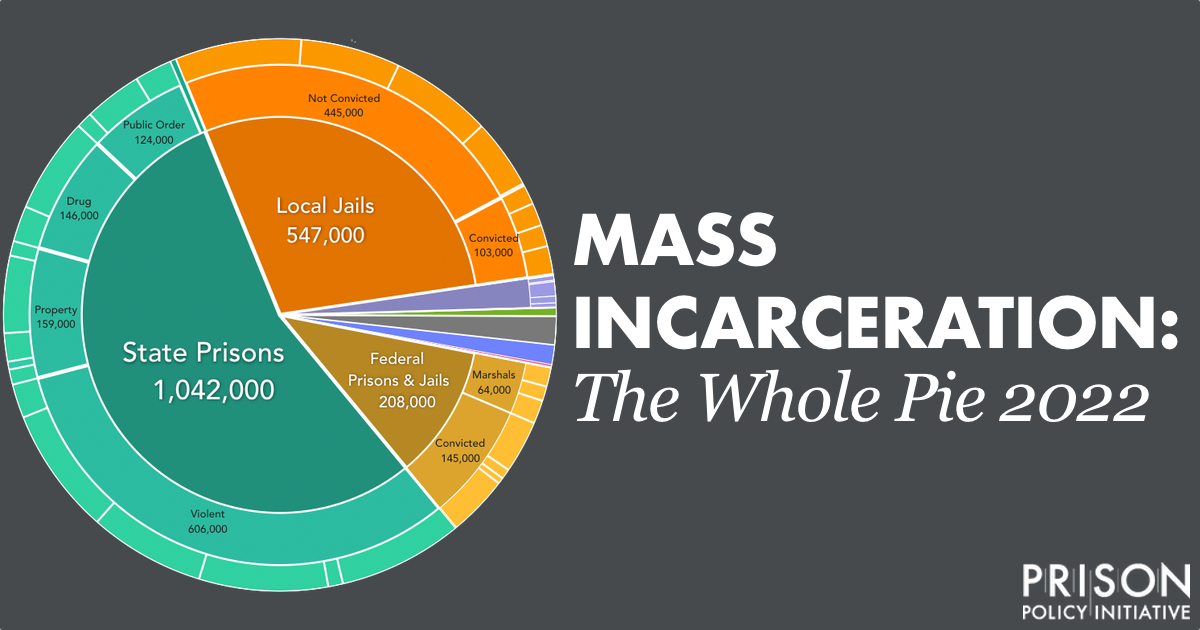

Mass Incarceration The Whole Pie 2022 Prison Policy Initiative

Massachusetts Paycheck Calculator Smartasset

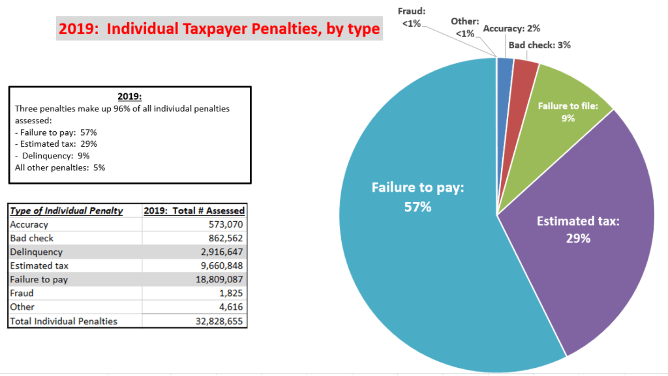

Do S And Don Ts When Requesting Irs Penalty Abatement For Failure To File Or Pay Penalties Jackson Hewitt

Massachusetts Graduated Income Tax Amendment Details Analysis

How To Make An Estimated Payment Youtube

Mass Taxpayers Will Get Billions Back Under Obscure 1980s Law Baker Says